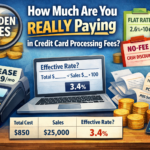

Credit card payments are the backbone of modern commerce. Yet, for small businesses, retailers, and e-commerce stores, the cost of processing these payments can eat away at profit margins. With credit card processing fees averaging between 1.5% to 3.5% per transaction, businesses often struggle to balance customer convenience and financial sustainability.

The solution? A surcharging program. If you’re unfamiliar with the concept or hesitant to adopt it, this blog outlines why surcharging could be the game-changer your business needs. At Merchant Marvels, we’re experts in helping businesses manage these costs, and we’re here to explain exactly how surcharging works and the benefits it provides.

What is a Surcharging Program?

A surcharging program is a way for businesses to pass credit card processing fees directly to customers who choose to pay with credit cards. Instead of absorbing processing costs, the fee—often a small percentage—is added to the total cost at the time of payment.

Here’s how it works in practice:

- When a customer pays with a credit card, the surcharge (typically no more than 4%, as per industry standards and legal guidelines) is added to their transaction total.

- If the same customer opts to pay via debit card, cash, or another method, no surcharge is applied.

Surcharging is becoming increasingly popular among small businesses that wish to maintain competitive pricing while offsetting increasingly high processing fees. When implemented properly and transparently, a surcharging program gives businesses more control over operational costs without alienating their customers.

A Brief Note on Compliance

Before implementing a surcharging program, businesses must comply with certain legal guidelines and payment network rules. These include notifying credit card companies in advance, following percentage caps on surcharges, and clearly disclosing fees to customers. Luckily, services like Merchant Marvels can streamline this process to ensure your business remains compliant while enjoying the benefits of surcharging.

Now that we’ve defined surcharging, let’s explore the five major reasons why your business needs this program to stay competitive and profitable.

1. Reducing the Burden of Credit Card Processing Fees

For small businesses, even a 2% processing fee can add up to thousands of dollars in annual costs. These fees are especially painful for businesses operating on tight margins, such as restaurants, boutique retailers, or e-commerce shops.

Surcharging allows businesses to directly offset these costs, making them more financially sustainable. Instead of taking a hit on every credit card transaction, the customer who opts for the convenience of a credit card pays a small fee for the associated transaction costs.

Key Benefits:

- Preserve your profit margins without increasing prices for all customers.

- Gain control over rising transaction fees, which continue to climb with premium rewards cards.

By reducing the burden of these fees, small businesses can reallocate their savings toward growth strategies such as marketing, hiring, or expanding product offerings.

2. Providing a Competitive Edge in Pricing

One of the most common ways small businesses offset credit card processing fees is by increasing prices wholesale. However, this approach can lead to lost competitiveness in price-sensitive markets.

Surcharging programs give businesses an alternative. By passing on processing fees only to credit card users, your base pricing remains competitive, and customers using cash or debit cards reap the benefit of lower prices.

Example:

Consider a sandwich shop that adds $0.25 to its menu pricing across the board to cover card fees. Now imagine instead using a surcharging program where the surcharge applies only to credit card purchases. Customers paying with cash or debit benefit from lower, uninflated pricing—making your business more attractive overall.

Surcharging allows you to preserve customer affordability while ensuring credit card convenience pays for itself.

3. Encouraging Cash and Other Non-Card Payments

Cash may be less common in today’s digital economy, but cash payments carry significant advantages for small businesses:

- There are no transaction fees with cash, increasing net revenue per sale.

- Transactions are immediate, helping with cash flow management.

A surcharging program inherently encourages cash or debit payment methods by giving customers the option to avoid the surcharge. The result? A win-win scenario where your business reduces costs, and many of your customers keep more money in their pockets.

Customers aren’t strangers to surcharges; many industries already employ them—think fuel surcharges for airlines or service fees at concert venues. Implementing a similar structure for payments can subtly shift customer behavior without creating friction.

4. Complying with Legal and Regulatory Guidelines

If your hesitation to implement surcharging stems from compliance concerns, rest assured that there are defined, manageable guidelines. Surcharging programs are fully legal in most U.S. states, provided you adhere to the following:

- Fee Cap: Surcharges are typically capped at 4% of the transaction value.

- Notification Requirements: Payment processors and card issuers often require prior notification before surcharging can begin.

- Transparency: Fees must be disclosed upfront. Signage at your physical store or clear messaging on your e-commerce checkout page ensures compliance and builds trust with your customers.

Merchant Marvels offers comprehensive onboarding for businesses considering surcharging, ensuring smooth implementation while fully adhering to state and federal regulations.

5. Improving Overall Business Profitability

When credit card processing fees are no longer a drain on your finances, profitability improves naturally. Over time, the savings accumulated from passing on processing fees can significantly impact your bottom line. Here’s how these extra profits can help:

- Reinvest in Your Business: Allocate savings towards marketing, employee wages, or product development.

- Maintain Competitive Margins: Avoid cutting corners just to manage costs—keep your business thriving.

- Weather Economic Challenges: During times of inflation or economic slumps, savings from surcharging contribute to financial stability.

For small businesses constantly battling razor-thin profit margins, the extra capital gained through surcharging can be a lifeline.

Real-Life Examples of Surcharging Success

To showcase the real-world benefits of surcharging, here are two examples of businesses that implemented programs with outstanding results.

1. A Neighborhood Café in Miami

The owner of a small café noticed rising costs as more customers used rewards-based credit cards. After consulting with Merchant Marvels, the café implemented a 3% surcharge on all credit card purchases. Customers appreciated the transparency, and nearly 40% of them switched to cash or debit. Within six months, the café saved approximately $8,700 in transaction fees.

2. A Regional E-commerce Retailer

An online clothing retailer struggled with slim margins due to the abundance of online discounts and high shipping costs. By introducing a surcharging program at checkout, the business preserved competitive pricing while reducing transaction costs by $12,000 in the first year alone.

These results demonstrate how businesses can thrive with careful and transparent implementation of surcharging programs.

Tips for Implementing a Surcharging Program

Interested in getting started? These tips will help ensure that your surcharging program is both compliant and ethical:

- Inform Your Payment Processor: Notify your credit card processor ahead of time, as required by law.

- Be Transparent: Clearly and prominently display details of your surcharge policy, both in-store and online.

- Train Your Staff: Ensure your employees can confidently explain surcharging to customers and dispel any potential myths.

- Use Reliable Solutions: Work with a trusted partner like Merchant Marvels to manage compliance, transparency, and seamless surcharge integration.

- Track Customer Feedback: Monitor how customers react to surcharges and adjust your approach if needed—communication is key.

These steps go a long way in building trust and ensuring a smooth transition to surcharging.

Common Concerns Debunked

Concerned customers may have misconceptions about surcharging, but these are often resolved with simple communication and proper implementation.

Misconception 1: Customers Will Be Alienated

Reality: Transparency and reasoning help mitigate concerns. Most customers understand that small businesses shoulder significant fees for credit card payments.

Misconception 2: It’s Difficult to Implement

Reality: With Merchant Marvels, you’ll have access to tools that simplify the process and ensure compliance.

Misconception 3: Surcharging is Illegal

Reality: While surcharging is banned in a small number of U.S. states, it is permitted in most, with clear rules for disclosure and implementation.

Addressing these concerns upfront can foster customer trust and smooth the adoption curve.

The Bottom Line

By implementing a surcharging program, you can strategically reduce costs, improve cash flow, and boost profitability—all without alienating your customers. For small businesses, retailers, and e-commerce stores, surcharging offers an effective way to manage rising credit card processing fees while maintaining competitive pricing.

At Merchant Marvels, we specialize in helping businesses like yours implement compliant, cost-effective surcharging programs. Want to learn more? Contact us today to explore how surcharging can improve your bottom line!

Don’t just manage costs—take control of them.