If you accept credit or debit cards, you pay processing fees on every transaction.

The problem? Most business owners don’t know exactly who gets paid and why.

This guide breaks it down in plain English, without jargon — so you can finally understand:

-

What interchange is

-

What assessments are

-

What your processor markup actually means

-

Where hidden fees usually live

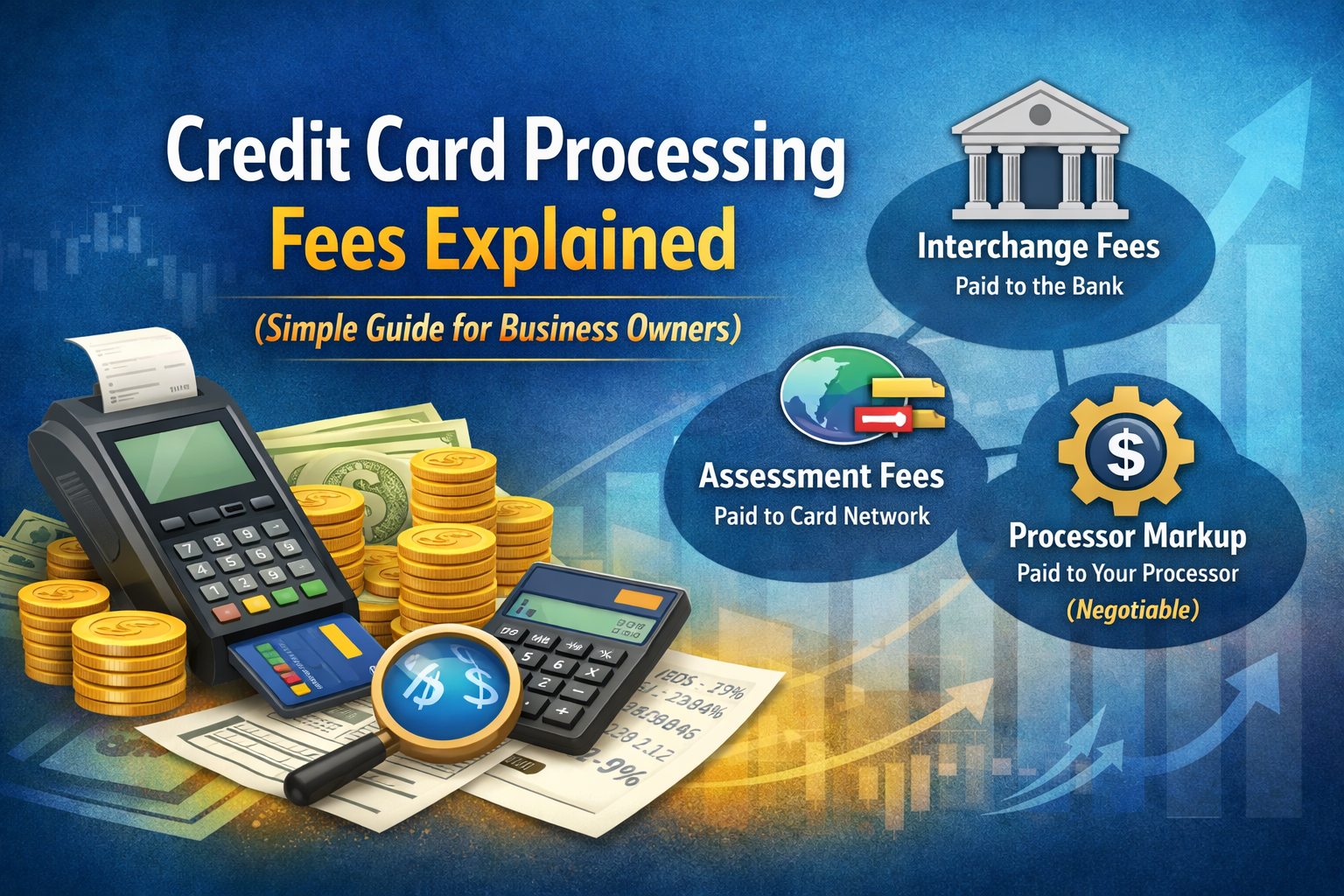

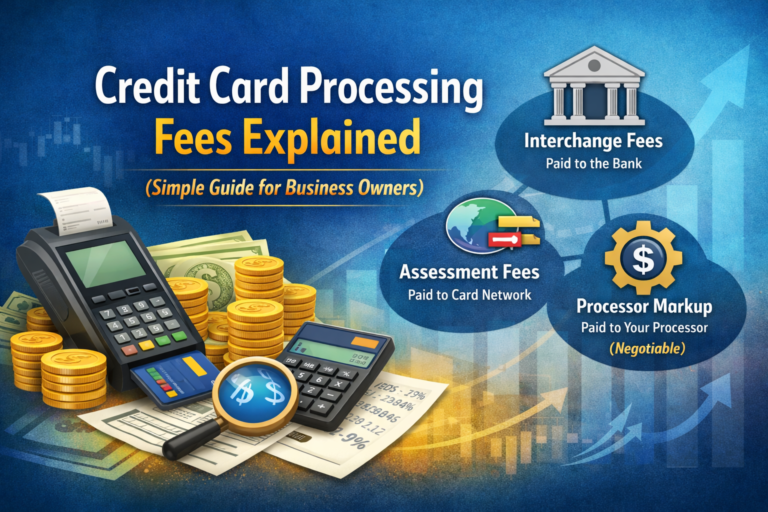

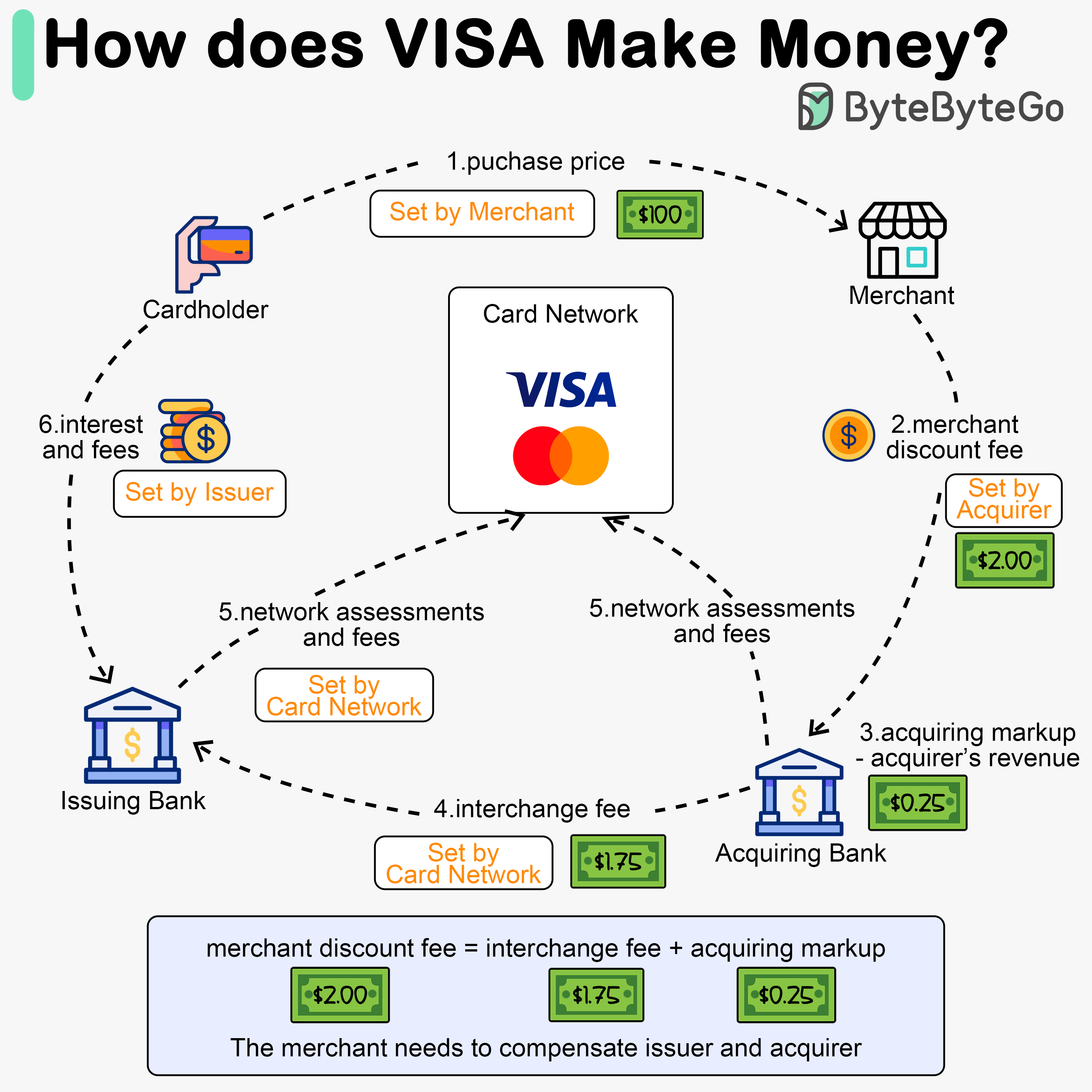

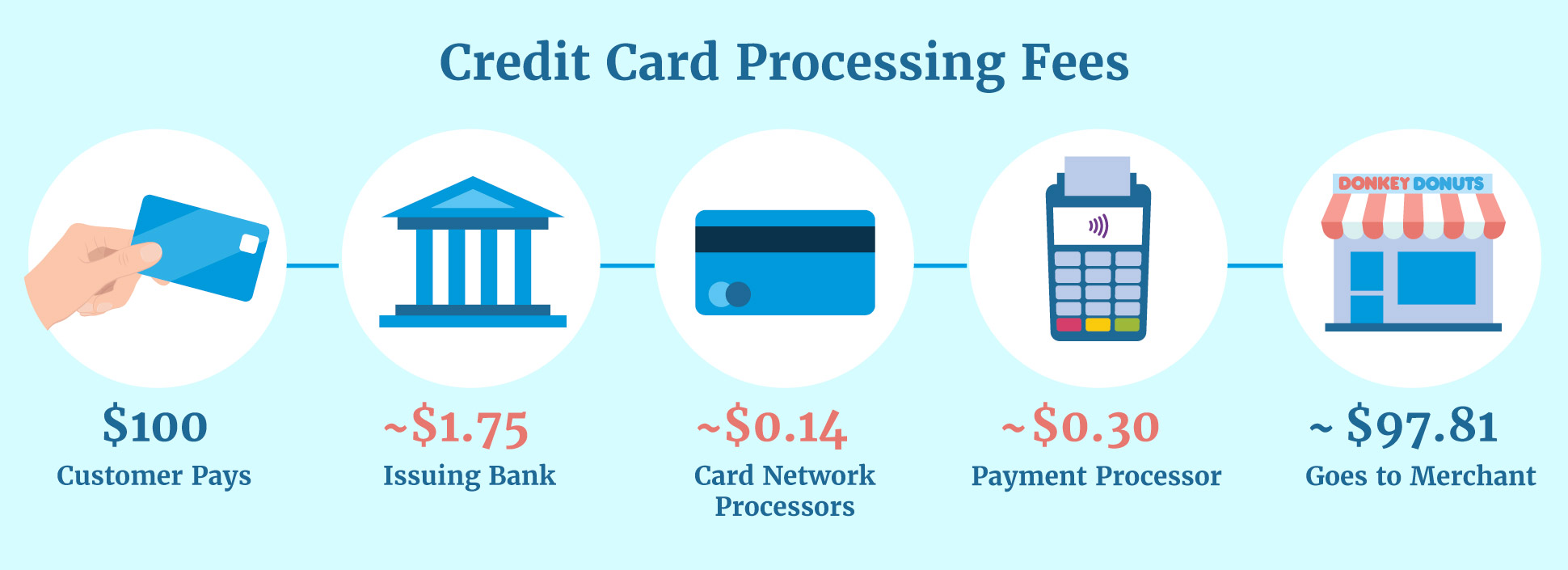

The Big Picture: Who Takes a Cut?

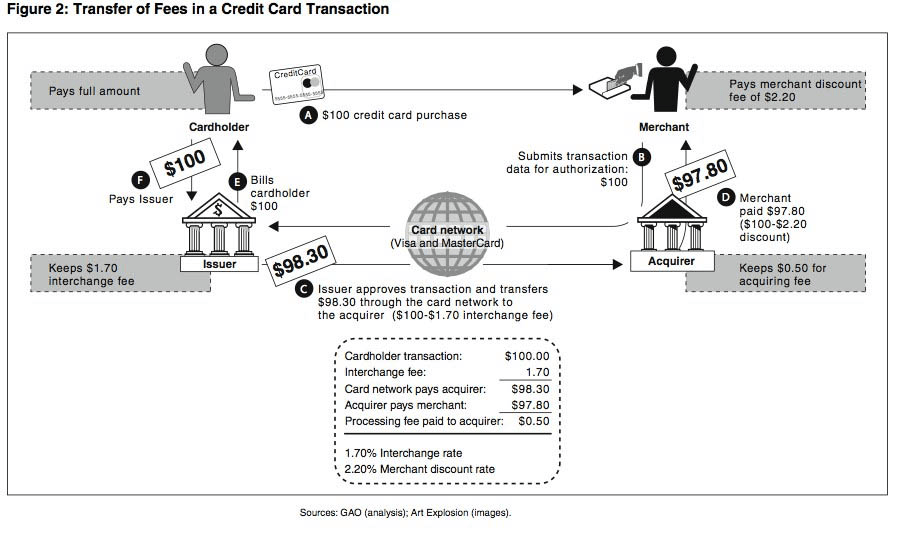

Every card transaction involves multiple players, not just your processor.

When a customer pays $100 using a card, the fee you pay is split between:

-

The customer’s bank (interchange)

-

The card network (assessments)

-

Your payment processor (markup)

Let’s break each one down.

1️⃣ Interchange Fees (The Biggest Part)

What is Interchange?

Interchange is the fee paid to the customer’s bank, not your processor.

If a customer uses a Chase card, Chase gets paid.

If they use Bank of America, BoA gets paid.

👉 This fee does NOT go to your processor.

Why Interchange Exists

Banks take on:

-

Fraud risk

-

Credit risk

-

Rewards programs (cash back, points, miles)

Interchange is how banks make money on card usage.

How Interchange Is Calculated

Interchange usually looks like this:

Percentage + Fixed fee

Example: 1.80% + $0.10

So on a $100 sale:

-

Percentage: $1.80

-

Fixed fee: $0.10

-

Total interchange = $1.90

What Affects Interchange Rates?

Interchange changes based on:

| Factor | Impact |

|---|---|

| Credit vs Debit | Credit costs more |

| Rewards cards | Higher fees |

| Business cards | Higher fees |

| Online vs In-store | Online costs more |

| Chip / Tap / Swipe | More secure = cheaper |

⚠️ You cannot negotiate interchange — it’s set by the card networks.

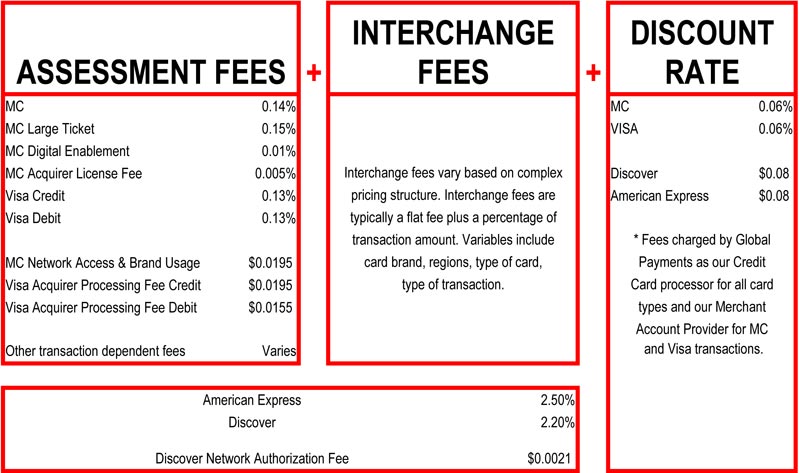

2️⃣ Assessment Fees (Small but Mandatory)

What Are Assessments?

Assessments are fees charged by the card networks for using their rails.

That means networks like:

-

Visa

-

Mastercard

-

American Express

-

Discover

Typical Assessment Fees

Assessments are usually around:

0.13% – 0.15% of transaction amount

On a $100 sale:

-

Assessment ≈ $0.13 – $0.15

Small? Yes.

Avoidable? ❌ No.

Key Thing to Know

Just like interchange:

-

Assessments are non-negotiable

-

Your processor passes them through to you

3️⃣ Processor Markup (The Only Negotiable Part)

What Is Processor Markup?

This is what your processor charges you for their service.

It covers:

-

Payment gateway

-

POS software

-

Customer support

-

Risk management

-

Profit

👉 This is the only part you can negotiate.

How Markup Is Charged

Processors usually charge markup in one of these ways:

🔹 Interchange-Plus Pricing

Interchange + Assessment + Markup

Example: 0.50% + $0.10

This is the most transparent pricing model.

🔹 Flat-Rate Pricing

Example: 2.6% + $0.10 on all cards

Simple, but often more expensive for businesses with volume.

🔹 Tiered Pricing (⚠️ Avoid)

Qualified / Mid-Qualified / Non-Qualified

This hides true costs and makes statements confusing.

Example Breakdown (Interchange-Plus)

$100 Credit Card Sale

| Fee Type | Amount |

|---|---|

| Interchange | $1.80 |

| Assessment | $0.14 |

| Processor Markup | $0.60 |

| Total Fee | $2.54 |

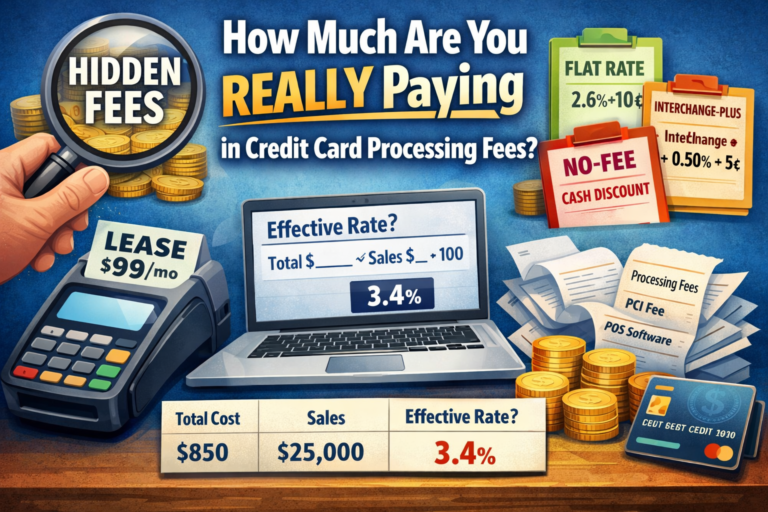

Where Business Owners Get Overcharged

Here’s where things go wrong 👇

🚩 Hidden Processor Fees

-

Statement fees

-

PCI fees

-

Batch fees

-

Monthly minimums

-

Non-compliance penalties

🚩 Inflated Markup

Processors quietly raise markup over time.

🚩 Flat Rate Used When It Doesn’t Make Sense

Flat rates hurt businesses with:

-

High monthly volume

-

Larger ticket sizes

-

Debit-heavy transactions

How to Tell If You’re Overpaying

Ask yourself:

-

Do I understand my statement?

-

Do I know my actual effective rate?

-

Is my pricing interchange-plus or flat rate?

-

Are there monthly fees I didn’t agree to?

If the answer is “no” — you’re probably paying more than you should.

Simple Takeaway (Save This)

Every credit card fee = 3 parts

-

Interchange → Goes to the bank

-

Assessment → Goes to the card network

-

Processor markup → Goes to your processor (negotiable)

👉 You cannot eliminate interchange or assessments,

but you can control markup and pricing structure.

Final Thought

Understanding credit card processing fees puts money back in your pocket.

Even a 0.3% reduction can mean thousands saved per year — especially for growing businesses.