Choosing a merchant processing provider is one of the most important financial decisions for your business — yet most merchants sign agreements without fully understanding what they’re agreeing to.

Processors love advertising “low rates” or “no setup fees.”

But the real cost is buried inside small monthly charges, penalty fees, and confusing contract terms.

This guide walks you through:

-

The critical questions to ask before signing

-

Every common merchant processing fee explained in plain English

-

How these charges quietly add up

-

What a fair agreement should actually look like

If you own a retail store, restaurant, salon, service business, or ecommerce brand — this article can save you serious money.

Let’s start.

Part 1: The Questions Every Business Owner Must Ask

Before you sign anything, slow down and ask these:

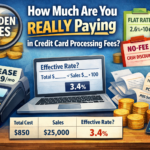

1. What Is My Exact Processing Rate — and How Is It Structured?

Never accept answers like:

-

“Around 2.5%”

-

“Industry standard”

-

“Depends on the card”

You need specifics.

Ask:

👉 Is this Flat Rate, Interchange-Plus, or Cash Discount/Surcharge?

Flat Rate

One price for all cards (example: 2.5% + 10¢)

Pros

-

Simple

-

Predictable

Cons

-

Usually more expensive long-term

Interchange-Plus

You pay the real card cost + processor markup

(example: interchange + 0.5% + 5¢)

Pros

-

Transparent

-

Often cheapest at higher volumes

Cons

-

Statements look more complex

Cash Discount / Surcharge

Card fees are passed to customers (within legal limits).

Pros

-

Can dramatically reduce processing costs

-

Popular with retail & service businesses

Cons

-

Must be set up correctly to stay compliant

Always ask:

“Can you show me a real example based on $10,000 per month in sales?”

If they won’t — walk away.

2. Are There Any Monthly, Annual, or Hidden Fees?

This is where most merchants lose money.

Ask directly:

-

Monthly account fee?

-

Statement fee?

-

PCI compliance fee?

-

PCI non-compliance penalty?

-

Annual fee?

-

Regulatory/network fee?

-

Batch fee?

-

Minimum monthly processing fee?

-

Software fees?

Individually these look small. Together they quietly drain thousands per year.

Which brings us to…

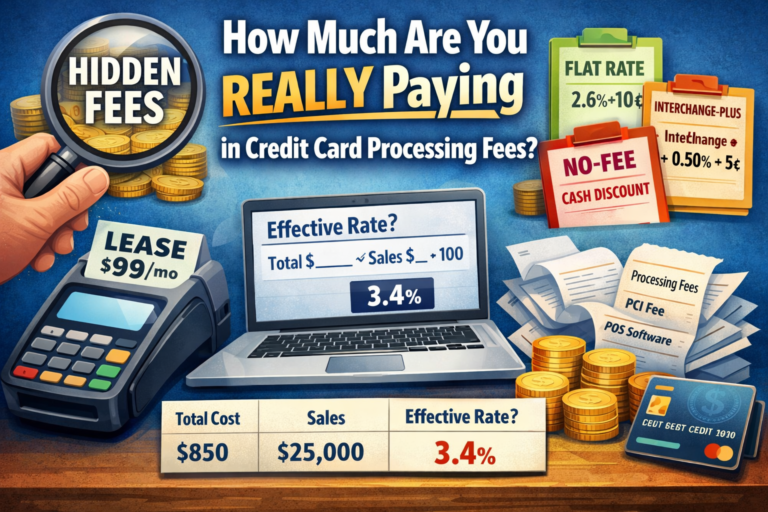

Part 2: Every Merchant Processing Fee Explained (Plain English)

Let’s break down each one.

Monthly Account Fee (Monthly Service Fee)

What it is

A flat charge just for having an active merchant account.

Typical range: $5–$25/month

Why it exists

Processors say it covers account maintenance and support.

Reality: it’s guaranteed recurring revenue.

Example

$15/month = $180/year

Before you even process a dollar.

Statement Fee

What it is

A monthly charge just to generate your billing statement.

Typical: $5–$10/month

Yes — some processors charge you to see your own bill.

$7/month = $84/year

Pure overhead.

PCI Compliance Fee

What it is

A fee for helping you meet security requirements protecting card data.

Typical:

-

$8–$20/month

or -

$80–$150/year

What it should include

-

PCI questionnaire

-

security guidance

-

reminders and support

Reality

Many processors charge this but offer little actual help.

So merchants pay — and still become non-compliant.

PCI Non-Compliance Fee (Penalty Fee)

This one hurts.

What it is

A monthly penalty if PCI is not completed.

Typical: $20–$40/month

Example

$30/month = $360/year

Just for not finishing compliance.

Many merchants don’t even realize this is happening — it’s often hidden as:

-

Security fee

-

Regulatory fee

-

Compliance adjustment

Same thing.

Annual Fee

What it is

A once-per-year “account maintenance” charge.

Typical: $50–$150/year

Modern processors usually remove this entirely.

Older ones stack it on top of monthly fees.

Regulatory / Network Fee

Sounds official.

It usually isn’t.

What it is

A vague monthly or percentage charge.

Typical:

-

$3–$10/month

or -

small percentage of volume

Translation: disguised processor markup.

Batch Fee (Settlement Fee)

What it is

A small fee charged every time you close your terminal for the day.

Typical: $0.10–$0.30 per batch

If you batch daily:

$0.25 × 30 days = $7.50/month

≈ $90/year

Restaurants and retail feel this most.

Minimum Monthly Processing Fee

This punishes small businesses.

What it is

A minimum profit guarantee for the processor.

Example:

Processor requires $25/month.

If your activity only generates $12, they charge the remaining $13.

Even during slow months.

Typical minimums: $15–$35/month

Software Fees (POS / App Fees)

What it is

Monthly charges for:

-

POS software

-

inventory tools

-

reporting dashboards

-

virtual terminals

-

booking systems

Typical: $10–$50+ per month

Sometimes per device.

Many “free POS” offers still charge:

-

software fee

-

device management fee

-

reporting fee

Suddenly your “free” system costs $600+ per year.

Real Example: How Fees Quietly Add Up

Let’s say a merchant has:

-

Monthly account fee: $15

-

Statement fee: $7

-

PCI fee: $10

-

PCI non-compliance penalty: $30

-

Software fee: $25

-

Batch fees: $7

That’s:

👉 $94/month

👉 $1,128/year

Before processing rates.

This is why so many business owners feel like they’re bleeding money.

Part 3: Contract Questions That Matter

Is There a Long-Term Contract or Cancellation Fee?

Some processors lock merchants into:

-

3-year terms

-

automatic renewals

-

$300–$500 early termination fees

Best option:

✅ Month-to-month

✅ No cancellation penalty

✅ No auto-renewal

Do I Own My Equipment — or Am I Leasing It?

Critical.

Many merchants unknowingly sign non-cancelable equipment leases costing:

$50–$100/month for 4–5 years

= $2,500–$6,000 for a device worth a few hundred dollars.

If it’s leased — run.

Proper providers offer free placement or upfront purchase.

What Support Do I Get After Signup?

Ask:

-

Dedicated account manager?

-

24/7 support?

-

Help with chargebacks?

-

Equipment replacement?

Many processors disappear after onboarding.

Real support matters when something breaks on a Saturday night.

Will You Review My Current Statement?

Any honest provider should offer a free statement analysis showing:

-

what you pay now

-

where money is being lost

-

realistic savings

If they won’t review it — they’re guessing.

Final Checklist Before Signing

Use this:

✅ Clear pricing model

✅ Full written fee schedule

✅ No long-term contract

✅ No cancellation penalty

✅ No equipment lease

✅ PCI included

✅ No hidden minimums

✅ Software explained

✅ Real support

If any box isn’t checked — pause.

Final Advice

Merchant processing contracts are written by lawyers — not business owners.

A rushed 10-minute signup can lock you into years of unnecessary costs.

Slow down. Ask questions. Demand transparency.

The right processor welcomes this.

The wrong one pressures you to “sign today.”