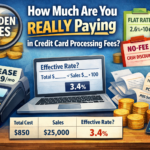

If you’re a small business owner, retailer, or e-commerce entrepreneur, accepting credit card payments is likely a crucial part of your operations. However, navigating the fees associated with credit card transactions can feel overwhelming. One of the most important costs you’ll encounter is interchange fees, which vary depending on the type of program you choose—Interchange Plus or Flat Fee.

At Merchant Marvels, we aim to simplify these concepts to help you make the best financial decisions for your business. Here’s everything you need to know.

Understanding Interchange Fees

Interchange fees are charges paid by a merchant’s payment processor to the credit card issuer (e.g., Visa or Mastercard) for each transaction. These fees make it possible for credit card issuers to facilitate secure payments while managing risks like fraud and chargebacks.

Typically, interchange fees are based on a percentage of the sale amount (e.g., 1.5%–3.5%) plus a fixed fee (e.g., $0.10–$0.30 per transaction). Factors like the type of card (e.g., debit, credit, or rewards card), transaction size, and industry can influence these fees.

Why Should Merchants Care About Interchange Fees?

Interchange fees often form a significant portion of your total payment processing costs. Understanding them can help you decide which pricing plan—Interchange Plus or Flat Fee—is the best fit for your business.

Interchange Plus vs. Flat Fee Programs

What is Interchange Plus?

An Interchange Plus program splits out the interchange fee from the processor’s markup. For example, you might be charged the interchange fee (set by Visa or Mastercard) plus 0.3% and 10 cents per transaction for the processor’s margin.

Example:

- Interchange Fee: 1.5% + $0.10

- Processor’s Markup: 0.3% + $0.10

- Total Cost of the transaction = 1.8% + $0.20

This structure gives you full visibility into the costs you’re paying and what portion goes to your processor.

Advantages:

- Pricing transparency makes it easier to see and evaluate your total costs.

- Lower processing costs for businesses handling high-value transactions.

- Better suited for businesses where interchange fees vary (e.g., those with a mix of card types).

Disadvantages:

- Monthly costs can fluctuate significantly depending on the mix of cards and transaction sizes.

- Slightly more complex billing statements to analyze.

What is a Flat Fee Program?

A Flat Fee program charges you a single, consistent rate. For example, a processor might charge you 2.5%+ few cents per transaction with no additional fixed costs.

Example:

- Flat Fee Charge = $10 sale x 2.5%+ 5 cents= $0.30

This method simplifies payment processing and eliminates the variability of interchange fees.

Advantages:

- Predictable billing, making budgeting easier.

- Ideal for low-volume or small-ticket transactions.

Disadvantages:

- Can result in higher costs for businesses handling high-value transactions.

- Less transparent—hard to determine if you’re overpaying compared to an Interchange Plus program.

Real Business Examples

- Retail Shop (High-Volume, Low-Ticket Sales): A small clothing shop processes hundreds of smaller transactions (e.g., $20–$50). A Flat Fee structure allows the shop owner to budget easily without being impacted by fluctuations in card type.

- E-commerce Business (Low-Volume, High-Ticket Sales): An online store that sells electronics with high average ticket prices (e.g., $500 per product) saves more with Interchange Plus because the interchange portion is relatively fixed.

Considerations for Choosing the Right Program

When deciding between Interchange Plus and Flat Fee programs, take the following into account:

- Transaction Volume

- Low volume? Flat Fee programs minimize complexity.

- High volume? Interchange Plus can offer better long-term savings.

- Average Transaction Value (Ticket Size)

- Smaller transactions benefit from Flat Fee pricing.

- Larger transactions favor Interchange Plus for lower processing costs.

- Industry Standards

- Some industries naturally have higher interchange fees. Understanding your sector’s typical rates can help you make the best choice.

Pricing Transparency and Predictability

Transparency is one of the main differentiators between these two pricing models.

- Interchange Plus clearly outlines costs, making it easier for you to understand where your money is going.

- Flat Fee offers predictable rates, which can be appealing to businesses seeking simplicity.

Ask yourself, does your business prioritize consistency or cost savings?

Negotiating with Payment Processors

No matter the program you choose, negotiating is key to securing the most competitive rates from payment processors. Here are some tips to get started:

- Compare Quotes: Don’t settle for the first offer. Request rate quotes from multiple providers and compare.

- Use Your Data: Analyze your transaction history and identify trends, such as average ticket size, transaction volumes, or card mix. Use this knowledge for leverage during negotiations.

- Ask for Discounts: Some processors provide discounts for businesses with high transaction volumes or consistent payment history.

- Review Contracts Carefully: Look out for hidden fees, such as account maintenance or cancellation charges.

Choosing the Best Program for Your Business

At Merchant Marvels, we recommend evaluating your specific needs and operational goals before making a choice. Here’s a quick summary to guide you:

|

Business Type |

Best Program |

Why? |

|---|---|---|

|

High Volume + Low Ticket |

Flat Fee |

Simplifies processing and budgeting. |

|

High Value + Low Volume |

Interchange Plus |

Reduces processing costs for large-value transactions. |

Final Recommendations

Interchange fees are an unavoidable cost of accepting credit cards, but by choosing the right program—be it Interchange Plus or Flat Fee—you can reduce these expenses. Consider your transaction volume, ticket size, and industry needs when selecting the plan that aligns best with your business model.

At Merchant Marvels, we’re dedicated to helping business owners make informed decisions about payment processing. Contact us today to learn more about the options available or request a quote tailored to your business.

Take the first step to smarter processing. Talk to our team today!