Why Free Equipment Placement Is the Smartest Choice for Businesses in 2026

When businesses start accepting card payments, one of the first big decisions they face is how to get their POS equipment.

Most merchants assume they have only two options:

-

Buy the POS outright, or

-

Lease the equipment (often unknowingly signing long-term contracts)

But there is a third option—and for most small and mid-sized businesses, it’s the smartest one:

👉 Free Equipment Placement

In this guide, we’ll break down all three options, compare real costs, uncover hidden risks, and explain why free equipment placement has become the preferred choice for modern businesses.

Understanding the Three POS Equipment Options

Let’s start by clearly defining each model.

Option 1: Buying POS Equipment Outright

What It Means

You purchase the POS hardware upfront using cash or financing. You own the device from day one.

Typical Costs

| Device | Average Cost |

|---|---|

| Clover Flex | $500 – $700 |

| Clover Mini | $800 – $1,200 |

| Clover Station Duo | $1,800 – $2,500 |

| Printers / Scanners | $300 – $800 extra |

Total upfront investment:

👉 $1,200 – $3,000+ per location

Pros of Buying Equipment

✔ You own the hardware

✔ No equipment return requirements

✔ Freedom to switch processors (sometimes)

Cons of Buying Equipment

❌ Large upfront cash outflow

❌ No guarantee of compatibility with future processors

❌ No protection against hardware failure

❌ Technology becomes outdated quickly

❌ You still pay full processing fees

💡 Reality Check:

POS systems evolve every 3–5 years. Owning hardware often means you’re paying thousands for something that will soon be obsolete.

Option 2: Leasing POS Equipment (The Most Expensive Mistake)

What It Means

You “rent” the POS hardware through a leasing company, usually tied to your processor.

What Merchants Are Rarely Told

-

Lease terms are 36–48 months

-

Contracts are non-cancelable

-

You pay 5–7× the equipment’s actual value

-

Even if you stop using the POS, you still pay

Real Leasing Cost Example

| Item | Cost |

|---|---|

| Clover Station Duo retail value | ~$2,000 |

| Lease payment | $59/month |

| Lease term | 48 months |

| Total paid | $2,832 |

➡️ And you still don’t fully own it until the lease ends.

Pros of Leasing (Very Few)

✔ Low upfront cost

Cons of Leasing (Major Red Flags)

❌ Long-term financial trap

❌ Extremely expensive over time

❌ Separate lease company (hard to cancel)

❌ No flexibility if your business changes

❌ Continues even if processor changes or business closes

🚨 Industry Truth:

POS leasing is one of the most criticized practices in merchant services.

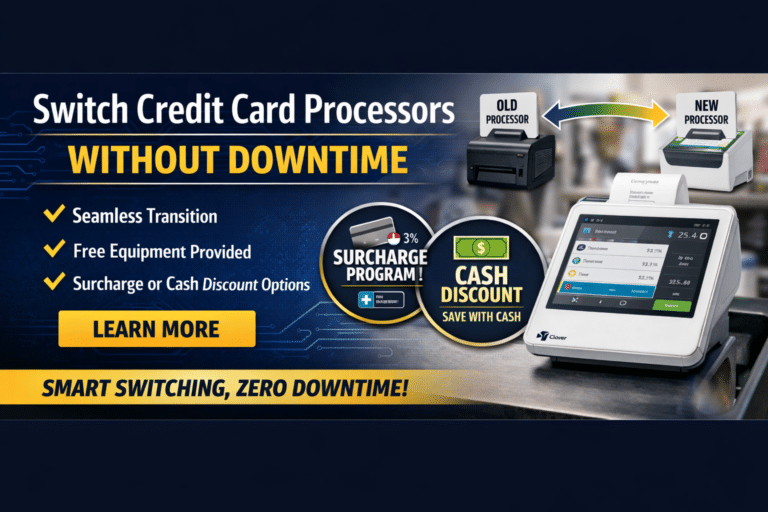

Option 3: Free Equipment Placement (The Smart Alternative)

What Is Free Equipment Placement?

Under a free equipment placement program, your payment processor provides POS hardware at no upfront cost, as long as you process payments with them.

You don’t buy it.

You don’t lease it.

You simply use it while processing payments.

What You Actually Pay

✔ $0 upfront for equipment

✔ No lease payments

✔ No interest

✔ No financing

✔ No long-term equipment debt

Instead, the processor earns revenue through transaction processing—which you’re already paying anyway.

Why Free Equipment Placement Is Better for Most Businesses

Let’s break it down clearly.

1. Zero Upfront Capital = Better Cash Flow

Cash is king—especially for:

-

New businesses

-

Retail stores

-

Restaurants

-

Salons & barbershops

-

Service businesses

Instead of spending $2,000–$3,000 on hardware, you can use that money for:

-

Inventory

-

Marketing

-

Payroll

-

Rent

-

Growth initiatives

📌 Free equipment placement removes financial friction.

2. No Long-Term Equipment Debt

With free placement:

-

No 36–48 month contracts

-

No separate leasing company

-

No penalties for early exit (with the right provider)

If your business evolves, you’re not stuck paying for equipment you no longer use.

3. Built-In Upgrades & Technology Protection

POS technology changes fast:

-

New payment methods

-

Faster processors

-

Better reporting

-

Inventory automation

-

AI-driven insights

With free equipment placement:

✔ You’re not locked into outdated hardware

✔ Upgrades are easier

✔ Equipment replacement is simpler

Owning equipment locks you into yesterday’s technology.

4. Lower Risk for New & Growing Businesses

If your volume changes, location changes, or business model shifts:

-

You’re not stuck with unused hardware

-

You’re not paying lease penalties

-

You’re not trying to resell POS equipment

Free placement keeps your business agile.

5. Better Alignment Between You & Your Processor

With free placement:

-

Your processor is invested in your success

-

They want you to process more—not lock you into equipment debt

-

Support and service quality typically improves

This creates a partnership, not a hostage situation.

Cost Comparison: Buying vs Leasing vs Free Placement

| Category | Buying | Leasing | Free Placement |

|---|---|---|---|

| Upfront cost | High | Low | $0 |

| Long-term cost | Medium | Very High | Low |

| Contract risk | Low | Very High | Low |

| Flexibility | Medium | Very Low | High |

| Upgrade ease | Low | Very Low | High |

| Cash flow impact | Negative | Ongoing drain | Positive |

Common Myths About Free Equipment Placement

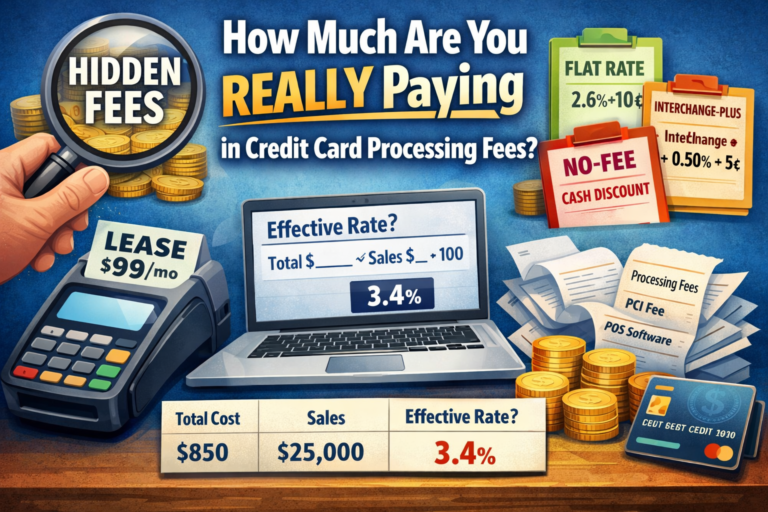

❌ “It’s not really free”

✔ The equipment is provided in exchange for processing—no hidden lease or purchase obligation.

❌ “Processing fees are higher”

✔ When structured correctly, free placement can be paired with competitive flat-rate, interchange-plus, or no-fee programs.

❌ “I don’t own the equipment”

✔ Ownership doesn’t matter when:

-

There’s no upfront cost

-

No lease

-

No maintenance burden

-

Easy upgrades

Who Should Choose Free Equipment Placement?

✔ Startups

✔ Retail stores

✔ Restaurants & cafes

✔ Salons & spas

✔ Medical & dental offices

✔ Service-based businesses

✔ Any merchant wanting low risk + high flexibility

When Buying Equipment Might Make Sense

Buying may work if:

-

You have large cash reserves

-

You plan to self-manage POS software

-

You fully understand compatibility risks

Even then, many businesses still prefer free placement.

Final Verdict: Why Free Equipment Placement Wins in 2026

In today’s business environment:

-

Cash flow matters

-

Flexibility matters

-

Speed matters

-

Technology changes fast

👉 Free equipment placement delivers all four advantages.

It removes risk, reduces cost, and allows businesses to focus on growth—not hardware debt.

Looking for Free POS Equipment Without Contracts or Hidden Fees?

Merchant Marvels specializes in free POS equipment placement, including:

-

Clover Flex

-

Clover Mini

-

Clover Station Duo

With options for:

-

Flat-rate pricing

-

Interchange-plus

-

No-fee / surcharge programs

📩 Contact us today to see if your business qualifies.