Managing finances efficiently is crucial for startups, especially when resources are constrained. One major aspect of finances that plays a critical role in business operations is payment processing. Choosing the right payment solutions as a startup can mean the difference between thriving and struggling. The good news is that there are innovative, cost-effective options available that cater specifically to small businesses and startups operating on a tight budget.

This blog post will explore various payment solutions, their benefits for startups, and ways to overcome common challenges. Whether you’re looking to upgrade your current system or searching for your first payment solution, we’ve got you covered.

Challenges Startups Face with Payment Solutions

Before jumping into solutions, let’s understand why selecting the right payment method can be so challenging for startups.

1. Budget Constraints

Startups often lack the capital to invest in expensive traditional payment systems like point-of-sale (POS) hardware or advanced software. These costs can quickly add up, creating barriers for small businesses right out of the gate.

2. Security Concerns

Cybersecurity is one of the most significant challenges in the modern business environment. Payment solutions need to protect sensitive customer financial information while ensuring compliance with regulations, such as PCI DSS. However, robust security measures often come with high costs, making them unaffordable for startups.

3. Flexibility and Scalability

Startups grow and evolve, meaning their payment solutions need to adapt seamlessly. Whether you’re adding a new sales channel or expanding internationally, rigid payment processing systems can slow down your progress.

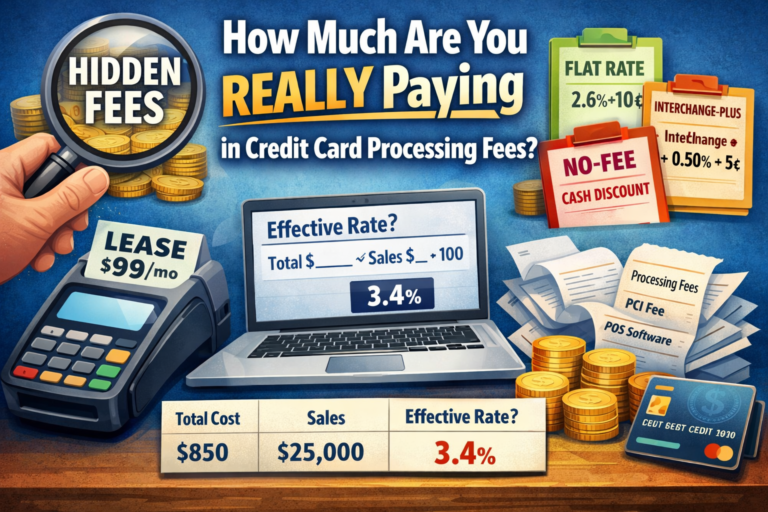

4. Transaction Fees

Small businesses often struggle with high transaction fees. For startups processing a large volume of small transactions, these fees can eat into profit margins, reducing the revenue available for growth and reinvestment.

5. Customer Experience

Today’s consumers expect a quick, seamless, and user-friendly checkout experience. Any hiccups in the payment process—such as limited payment methods or too many steps—can lead to cart abandonment and lost revenue.

6. Managing Multiple Payment Channels

Many startups operate through multiple sales channels—online stores, social media, or even offline pop-ups. Keeping track of payments coming from different sources can be chaotic without a system that aggregates and manages all payment channels.

Cost-Effective and Innovative Payment Solutions for Startups

Fortunately, there are several modern payment solutions designed to address these challenges. Let’s look at how each solution can help your startup save time, money, and resources.

1. Mobile Payment Options

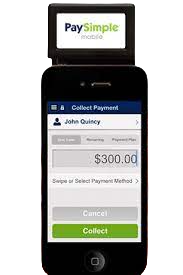

Gone are the days when businesses needed bulky POS systems to accept payments. Mobile payment options allow startups to process transactions using smartphones or tablets, significantly reducing setup costs.

Key Benefits of Mobile Payment Options

- Cost Savings: Eliminate the need for expensive hardware or dedicated payment terminals.

- Easy Setup: Perfect for retail startups, pop-up shops, and businesses on-the-go.

- Customer Convenience: Enables smooth transactions using credit/debit cards, contactless payments, or even QR codes.

One example is our free mobile POS solution, which is ideal for startups. Unlike traditional POS systems, our mobile POS comes with zero monthly fees, no contracts, and no cancellation fees! It’s a risk-free way to implement a reliable payment system for your business.

2. Digital Wallets

Digital wallets like PayPal, Apple Pay, and Google Pay allow customers to store payment details securely and make instant payments. They’re convenient for consumers and very affordable for small businesses to integrate.

Key Benefits of Digital Wallets

- Fast Transactions: Payments are nearly instant, reducing wait times for customers.

- Enhanced Security: Encrypted payment processes protect sensitive data from fraud.

- Streamlined Checkout Process: Customers can pay effortlessly with one click.

For startups operating online, integrating digital wallets can lead to better customer retention. Studies show that easier checkout processes reduce cart abandonment rates significantly.

3. Online Payment Gateways for Small Businesses

Startups heavily dependent on e-commerce should look into online payment gateways like Stripe, Square, or Shopify Payments. These platforms are tailored to fit the needs of smaller businesses and usually offer competitive rates.

Key Benefits of Online Payment Gateways

- Customizable Options: Many gateways allow you to create a branded checkout experience that matches your site’s design.

- Global Reach: Enable businesses to accept payments from international customers.

- Scalable Features: Start small and upgrade as your business grows without paying for unnecessary features upfront.

4. Subscription Billing Services

For startups offering subscription-based services, automated billing platforms like Recurly or Chargebee are essential. These tools simplify the process of recurring billing, ensuring consistent cash flow while saving valuable time.

Key Benefits of Subscription Billing Services

- Automated Billing: Streamlines repetitive tasks and eliminates human error.

- Customer Retention: Sends automatic reminders for renewals and invoices.

- Analytics: Tracks customer payments and provides insights into payment trends or delays.

Subscription billing features can help startups plan their revenue more effectively by ensuring predictable monthly income.

5. Peer-to-Peer (P2P) Payment Platforms

Apps like Venmo, Zelle, and Cash App simplify payments between businesses and customers or even between team members in small startups.

Key Benefits of P2P Payment Platforms

- Low Fees: Relatively lower transaction costs than traditional credit card processors.

- Ease of Use: Convenient for small-scale payments or transfers.

- Real-Time Transfers: Instant fund transfers ensure you have access to cash flow when needed.

P2P platforms are especially valuable for startups operating in informal settings, such as flea markets, food trucks, or local events.

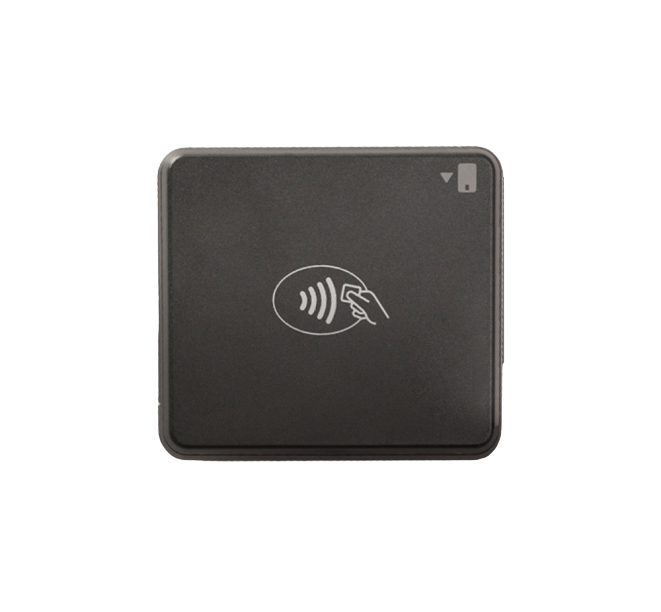

6. Free Mobile POS Solution

One of the most game-changing payment tools you can adopt for your startup is a mobile POS solution (PAX A920 & Devajoo QD2)—like our own offering! Here’s why it’s a no-brainer for small businesses operating on a budget.

Why Choose Our Mobile POS?

- Zero Monthly Fees: Focus your funds on growing your business, not maintaining a payment system.

- No Contracts or Cancellation Fees: Try our mobile POS solution without worry or commitment.

- All-in-One Platform: Accept payments via credit cards, debit cards, digital wallets, and more—all from a single app on your smartphone or tablet.

- Easy to Use: The simple interface ensures your team can quickly learn and operate the system.

Whether you’re running a coffee cart, managing a small boutique, or operating an art studio, our mobile POS can adapt to your needs and ensure you spend less time worrying about payment logistics and more time focusing on your customers.

Tips for Implementing Payment Solutions on a Budget

Now that you know the options, here are some practical tips to help you maximize value while staying within your budget.

- Negotiate Transaction Fees – If possible, discuss lower rates with your payment processor, especially if your transaction volume is high.

- Leverage Free Tools – Many providers offer free versions of their software with adequate functionality for startups. Upgrade only when necessary.

- Focus on Scalability – Choose payment solutions that can grow along with your business rather than having to switch systems down the line.

- Test Before Committing – Take advantage of free trials to test the usability and scalability of a solution before implementing it across your operations.

The Future of Payment Solutions for Startups

The world of payment solutions continues to evolve, with trends like blockchain-based payments and AI-powered analytics making waves. While these technologies may seem futuristic, startups should keep an eye on their development to maintain a competitive edge.

Final Thoughts

Choosing innovative payment solutions as a startup is no longer a choice—it’s a necessity for staying competitive while operating within budget constraints. Solutions like mobile payment options, digital wallets, and peer-to-peer platforms make it easy to manage your finances while providing customers with a seamless experience.

Our free mobile POS solution is tailored for startups looking for a cost-effective and scalable way to process payments. With no monthly fees or contracts, it’s the ideal payment system to support your growth.

Take the leap and explore smarter payment solutions today to empower your startup with the tools it needs to thrive!