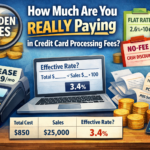

Card processing pricing isn’t just “rates.” In 2026, the best model depends on your average ticket, card-present vs online, rewards/commercial card mix, and whether you want to absorb fees or pass them to customers.

Recent coverage continues to put typical U.S. credit card acceptance costs around the ~2%–2.5% range for many merchants, with wide variation by card type and acceptance method.

Below is a practical, merchant-friendly guide with tables, benchmark ranges, and chart-ready examples you can use to choose the right pricing model in 2026.

Quick definitions (in plain English)

1) Interchange-Plus (Cost-Plus / “Pass-Through”)

You pay:

-

Interchange (set by networks/banks; varies by card type, rewards level, business card, etc.)

-

Assessments / network fees (small % fees)

-

Processor markup (your provider’s margin)

You get transparency—your cost goes up/down depending on the card mix.

2) Flat Rate (Blended)

You pay the same rate for most transactions (e.g., “2.6% + 15¢ in-person”), regardless of the card type.

Square’s published in-person pricing, for example, shows 2.6% + 15¢ (and other plan tiers).

Stripe’s standard online card pricing shows 2.9% + 30¢ for domestic cards.

Bankrate summarizes that many providers’ pricing typically falls into ranges like Square ~2.6%–3.5% and Stripe 2.9% + $0.30 depending on transaction type.

You get simplicity—but you often pay extra on “cheap” cards to cover the expensive ones.

3) Cash Discount / Dual Pricing / Surcharging

There are a few flavors:

-

Cash Discount (true discount): Your posted price is the card price, and customers paying cash get a discount.

-

Surcharge: You add an extra fee when a customer pays by credit card (rules and state laws apply).

-

Dual Pricing: You show two prices (cash and card) in a compliant way.

Mastercard’s published rules highlight key requirements such as advance notice (at least 30 days) and a maximum surcharge cap of 4% (and no surcharging on debit/prepaid).

Visa’s consumer-facing guidance also notes that surcharging is generally restricted unless permitted by law and must follow specific requirements.

Important: compliance details vary by state and by card brand; your processor should provide the correct setup and disclosures.

2026 industry benchmarks (what many merchants actually see)

Benchmark ranges (U.S. small business — typical, not guaranteed)

These are common real-world ranges you’ll see discussed by major finance/publisher sources:

| Pricing Model | Typical Effective Cost Range | Why it varies |

|---|---|---|

| Interchange-Plus | Often lands ~2.0%–3.2% total for many SMBs | Card mix (rewards/commercial), keyed vs tap, ticket size, risk, vertical |

| Flat Rate | Usually ~2.6%–3.5%+ depending on channel | Simple pricing, but blended to cover high-cost cards |

| Cash Discount / Surcharge | Can offset most/all fees if implemented correctly | Customer acceptance + compliance + debit rules + state rules |

Also worth noting: a proposed Visa/Mastercard merchant settlement reported in late 2025 discussed average fee reductions of about 0.1 percentage points over several years, plus rule changes that could impact acceptance choices. This is still subject to court approval and details can change.

“Which is best?” — the decision matrix

Use Interchange-Plus when…

Best fit for:

-

Higher monthly volume (you benefit from lower markups)

-

Larger average tickets (the “+¢” matters less; transparency matters more)

-

Businesses that want statement-level visibility and negotiation leverage

-

Merchants with a decent debit mix and more “basic” cards

Watch-outs:

-

You must understand your statement (or have someone who does).

-

Costs spike if your customers use more premium rewards or business cards.

Use Flat Rate when…

Best fit for:

-

Startups and small merchants who want predictability

-

Low volume or seasonal businesses

-

Businesses that don’t want statement complexity

-

Online-first brands that want one simple rate (Stripe-style pricing is a common reference point)

Watch-outs:

-

If you grow, flat rate can become expensive compared to interchange-plus.

-

You often “overpay” on debit/basic cards to subsidize premium cards.

Use Cash Discount / Dual Pricing when…

Best fit for:

-

Retail/service locations where customers accept cash incentives

-

Merchants with thin margins who want to stop absorbing fees

-

Businesses that can do clean signage + compliant receipts + proper setup

Watch-outs:

-

Requires careful compliance (disclosures, debit rules, caps, state rules).

-

Customer experience matters (some markets push back harder than others).

-

Mastercard caps surcharge at 4% and requires notice; debit/prepaid are not surchargeable.

Charts & tables (copy/paste ready)

Table A — Example pricing assumptions (benchmark-style)

Use these as “what-if” numbers in proposals:

| Component | Interchange-Plus Example | Flat Rate Example | Cash Discount / Surcharge Example |

|---|---|---|---|

| Base cost driver | Interchange varies by card | Fixed | Fee shifted to customer (credit only) |

| Typical in-person | Interchange + (0.20%–0.60%) + (5¢–15¢) markup (varies by provider) | 2.6% + 15¢ (example published pricing) | Surcharge up to cap; often ~3%–4% seen in market (must comply) |

| Typical online | Interchange + higher risk markups | 2.9% + 30¢ (example published pricing) | Harder sell for online checkout; compliance still applies |

Chart 1 — “Cost per $10,000 processed” (illustrative scenarios)

Assume 200 transactions/month (avg ticket $50).

Scenario inputs

-

Flat rate: 2.6% + 15¢

-

Interchange-plus (sample): 2.05% + 10¢ (example effective total; your real total depends on card mix)

-

Cash discount: merchant pays near $0 for credit fees (illustrative), but you must factor program costs + customer behavior and compliance

Monthly cost math (chart-ready):

| Model | Percent fees | Per-txn fees | Estimated monthly fees |

|---|---|---|---|

| Flat Rate | $10,000 × 2.6% = $260 | 200 × $0.15 = $30 | $290 |

| Interchange-Plus (example) | $10,000 × 2.05% = $205 | 200 × $0.10 = $20 | $225 |

| Cash Discount (illustrative) | $0–low | program-dependent | Varies |

How to turn this into a chart:

Plot the “Estimated monthly fees” bars: 290 vs 225 vs (varies).

Chart 2 — Break-even: when Interchange-Plus usually beats Flat Rate

A big driver is the per-transaction cents plus your card mix.

Rule of thumb:

-

If your business does lots of low tickets (coffee, convenience), the “+¢” matters a lot.

-

If your business does bigger tickets (auto repair, medical, home services), interchange-plus often wins—especially at scale.

Chart-ready data template (fill with your real rates):

| Avg Ticket | 200 txns/mo | Flat Rate 2.6%+15¢ | Interchange-Plus (your effective) |

|---|---|---|---|

| $10 | $2,000 | = 2,000×2.6% + 200×0.15 | = 2,000×X% + 200×Y¢ |

| $25 | $5,000 | … | … |

| $50 | $10,000 | … | … |

| $100 | $20,000 | … | … |

Why “Free POS under Equipment Placement” is a game-changer in 2026

Traditional POS decisions used to start with:

“Can I afford the hardware + software + setup?”

Equipment placement flips that:

1) You remove the biggest barrier: upfront hardware cost

Instead of spending thousands upfront on terminals, printers, or full POS kits, businesses can deploy modern POS immediately and keep cash for:

-

inventory

-

payroll

-

marketing

-

location upgrades

2) You upgrade operations on Day 1 (not “someday”)

Modern POS isn’t just “taking cards.” It drives:

-

faster checkout and tips

-

inventory and SKU tracking

-

staff permissions

-

sales reporting and category insights

-

customer data/receipts/loyalty flows (depending on system)

That operational lift can be worth more than small differences in basis points.

3) It makes fee strategies easier to implement (cash discount / dual pricing)

Many compliance headaches come from inconsistent receipts, weak signage, or manual math. A modern POS configured correctly can:

-

show card vs cash totals clearly

-

print compliant receipts (amount + surcharge/discount shown)

-

reduce staff confusion at checkout

(Still follow network and state rules—don’t “wing it.”)

4) It gives you leverage: you can choose the pricing model that fits your growth stage

A smart approach many businesses take:

-

Start simple (flat or managed pricing)

-

As volume grows, move to interchange-plus for transparency

-

If margins are tight, consider dual pricing/cash discount with proper compliance

Recommended “best choice” by business type (2026 shortcut)

| Business Type | Typical Best Fit | Why |

|---|---|---|

| Coffee, quick-serve, low tickets | Flat rate or optimized interchange-plus | Per-txn cents matter; speed & simplicity matter |

| Retail (mid tickets), salons, spas | Interchange-plus or dual pricing | Good balance of volume + customer acceptance |

| High-ticket services (repair, medical, B2B) | Interchange-plus | Transparency + often lower effective cost at scale |

| Online / invoices / subscriptions | Flat rate online pricing | Simplicity; published online rates common |

| Gas/convenience / high debit mix | Interchange-plus (often) | Debit + PIN mix can be favorable |

The “2026 answer” in one line

-

Want the lowest long-run cost and transparency? Go Interchange-Plus.

-

Want simplicity and predictable pricing today? Go Flat Rate.

-

Want to stop absorbing fees (and can do it cleanly)? Use Cash Discount / Dual Pricing with proper compliance.

-

And if you can get POS via free equipment placement, you remove the upfront barrier and can focus on what actually grows profit: faster checkout, better operations, and the right pricing strategy.