If you’re a small business owner in the USA, staying competitive means giving your customers convenient ways to pay. Cash-only days are long behind us, with most consumers now preferring to pay with credit cards, debit cards, or digital wallets. To offer these payment methods, you’ll need a merchant account. But what exactly is a merchant account, and what steps do you need to take to get one? We’ve got you covered.

This guide will break down everything you need to know about merchant account requirements, from documentation to compliance, giving you the information you need to start accepting payments with ease. Whether you’re just starting, or looking to switch providers, this comprehensive guide is tailored to small businesses across the USA.

What Is a Merchant Account, and Why Is It Important?

A merchant account is a type of business bank account that allows you to accept and process electronic payments such as credit and debit card transactions. Essentially, it acts as the intermediary that transfers funds from your customer’s card to your business bank account.

Why is this essential? Offering card payments not only improves customer convenience but can also boost your sales. Studies show that businesses that accept cards tend to see higher customer spending and improved cash flow. For small businesses, this can make all the difference in scaling upwards.

However, obtaining a merchant account requires jumping through a few hoops. From providing specific documentation to meeting certain industry standards, ensuring you fulfill all merchant account requirements can make the process smoother and faster.

Benefits of Having a Merchant Account:

- Broad Payment Options – Accept credit cards, debit cards, and even mobile wallets like Apple Pay or Google Pay.

- Faster Transactions – Payments are processed faster compared to traditional checks or bank transfers.

- Sales Growth – The convenience of card acceptance often boosts customer spending.

Now, let’s explore exactly what’s required to get your merchant account up and running.

Essential Merchant Account Requirements

Before you apply for a merchant account, it’s crucial to get organized. Knowing what documents and information are typically required will speed up your application process and lower your chances of rejection.

1. Business Type and Industry Considerations

Not all merchant accounts are created equal. Providers will evaluate your business based on its type and industry to determine the level of risk involved. For instance:

- E-commerce businesses are considered higher risk due to higher fraud concerns.

- Restaurants or retail stores that operate in lower-risk environments may find the process smoother.

If your business is classified as a high-risk industry, such as travel agencies or online gambling, you may need to look for specialized high-risk merchant account providers.

2. Documentation You’ll Need

Having the right paperwork at hand will make the application process far easier. Here’s a checklist:

- Business license: Proof that your business is registered and legitimate.

- Employer Identification Number (EIN): Issued by the IRS for tax reporting purposes.

- Business bank account details: Your merchant account funds need a destination.

- Financial statements: These help show the financial health of your business.

- Processing history: If applicable, providing transaction history with another provider can speed approval.

- Government-issued ID: e.g., a driver’s license or passport for identity verification.

- Void check: To confirm your business bank account details.

- Website compliance updates: If you’re an online business, your website should include a privacy policy, terms & conditions, and a refund policy.

Pro Tip: Keep scanned copies of these documents handy to submit applications quickly and efficiently.

3. Factors Affecting Approval and Account Setup Time

Several factors influence how quickly you can get approved for a merchant account:

- Credit History: Merchant account providers often run credit checks on owners. Ensure your personal and business credit scores are in good shape.

- Processing Volume: Outline your expected monthly transaction amounts. High volumes may cause added scrutiny unless your track record supports it.

- Transparency: Avoid errors or omissions in your application. Being upfront about your business model reduces delays.

While approvals typically take 2–5 business days, keep in mind that certain industries or high-risk designations may take longer.

Compliance and Security Measures

When dealing with card transactions, compliance and data security are non-negotiable. Ignoring security requirements can result in hefty fines and even lost customer trust.

1. PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security measures that every business accepting card payments must follow. These measures ensure sensitive customer data—like card numbers—is protected.

Compliance typically includes:

- Installing firewalls for secure data transmission.

- Encrypting card information.

- Regularly testing and monitoring payment systems.

Most merchant account providers will guide you through PCI compliance because it’s mandatory to avoid breaches and penalties.

2. Fraud Prevention Tools

Fraud can plague businesses that fail to take proper precautions. Choose a merchant account provider offering fraud prevention tools, such as:

- Address Verification Services (AVS): Matches billing address with the cardholder’s records.

- Transaction monitoring systems: Detect unusual patterns to block suspicious payments.

3. Data Security and Encryption

Always use SSL encryption for your website to ensure customer data is protected. If you’re storing payment data, adhere strictly to PCI standards or partner with a secure payment gateway provider.

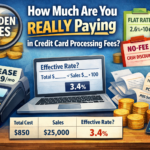

Fees and Processing Rates

Understanding the costs associated with a merchant account is vital for proper financial planning. Here’s a breakdown of common charges:

1. Common Fees for Merchant Accounts

Merchant accounts generally involve the following fees:

- Setup Fee: One-time fees to activate your account.

- Monthly Maintenance Fee: Ongoing charges for account management.

- Transaction Fees: Per-transaction costs for every card payment processed.

- Chargeback Fees: Applicable when customers dispute transactions.

2. Understanding Interchange Fees

Interchange fees are non-negotiable, as they are set by payment networks like Visa or Mastercard. They’re based on card type, transaction size, and risk factors. Know that these fees will form a significant portion of your processing costs.

3. Tips for Negotiating Competitive Rates

- Compare multiple providers, focusing on transparent pricing.

- Discuss volume-based discounts if your business processes high transaction amounts.

- Look for providers offering flat-rate pricing models—ideal for small businesses.

Integration and Support

Merchant accounts become far more useful when integrated with other business technology.

1. Integration with POS Systems and E-commerce Platforms

Choose a provider compatible with the tools you already use:

- POS Systems: Ensure smooth integration with platforms like Square, Clover, or Toast for in-store transactions.

- E-commerce Platforms: Seamlessly connect merchant accounts to Shopify, WooCommerce, or BigCommerce to accept payments online.

Integration ensures you can efficiently manage payments, customer data, and reporting from a unified system.

2. Importance of Reliable Customer Support

Customer support is a lifeline, especially for small businesses navigating technical issues. Look for providers offering:

- 24/7 customer service via multiple channels like phone, live chat, or email.

- A dedicated account manager for personalized assistance.

Conclusion and Next Steps

By now, you have a clear picture of what’s required to get a merchant account for your small business. From gathering documentation to choosing the right provider, the process starts with preparation and research.

Here’s a quick recap of key considerations:

- Ensure you meet industry-specific requirements.

- Be transparent and thorough with your application.

- Prioritize PCI compliance and other security measures.

- Understand associated fees to manage your costs effectively.

- Opt for seamless integration with your tech stack and prioritize strong customer support.

Take the Next Step with Merchant Marvels

Obtaining a merchant account doesn’t have to be daunting. At Merchant Marvels, we specialize in helping small business owners like you set up hassle-free merchant accounts tailored to your specific needs. Whether you’re new to card payments or looking for better processing rates, our team is here to assist.

[Get personalized advice from our experts today!]

Start accepting payments the right way—grow your business with Merchant Marvels.