In the rapidly evolving payments landscape, small and medium-sized businesses (SMBs) must keep pace or risk falling behind. In 2025, the key themes revolve around speed, security, integration and choice. Below are the most critical payment processing trends 2025 that SMBs should understand—along with practical SMB insights and how latest technology is reshaping the ecosystem.

1. Real-time & Instant Payments

One of the strongest shifts is the move toward faster payments. Instant- or near-instant settlement is becoming a baseline expectation. REPAY+2Citizens Bank+2

SMB insight: If you’re still waiting days for funds to hit your account, you’re at a disadvantage. Seek providers offering 24/7/365 settlement, faster funds availability, and real-time confirmation.

Technology angle: Payment rails such as real-time payment networks, API-driven transfers and account-to-account (A2A) payments are gaining traction. corporate.visa.com+1

2. AI, Machine Learning & Enhanced Fraud Prevention

Security continues to be a major concern—especially as digital payments proliferate. The latest tech such as artificial intelligence is being deployed to detect fraud, manage risk, optimize routing, and personalise experiences. corporate.visa.com+2LexisNexis Risk Solutions+2

SMB insight: Choose processors or platforms that include AI-powered fraud screening, behavioural analytics and anomaly detection—not just basic chargeback tools.

Technology angle: ML models trained on large payment datasets, biometric authentication, tokenisation and digital identity are becoming mainstream. Schooley Mitchell+1

3. Omnichannel & Embedded Payments

Consumers expect to pay seamlessly across channels: in-store, online, mobile, unattended terminals, even via social or IoT. For SMBs this means your payments architecture must support omnichannel flows. Finix+1

Embedded payments—payments built into software, platforms or service workflows—are also trending. Bottomline

SMB insight: Ensure your POS, e-commerce, mobile checkout and backend systems are integrated so payment data flows smoothly and you offer a consistent checkout experience.

Technology angle: APIs and payment SDKs that integrate into your business system (CRM, scheduling, booking etc) reduce friction and improve conversion.

4. Alternative Payment Methods & Digital Wallets

Credit/debit cards remain important—but digital wallets, BNPL (buy now, pay later), mobile-wallet payments and other alternatives are gaining share rapidly. Retail TouchPoints+1

SMB insight: Don’t just offer “card only” — enable digital wallets (e.g., Apple Pay, Google Pay), BNPL where applicable, and consider whether cross-border or A2A payments make sense for your business.

Technology angle: Tokenisation, wallet integrations, QR/NFC terminals and acceptance of new payment rails will help you future-proof your payment stack.

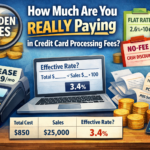

5. Cost Pressures, Fee Transparency & Value-added Services

With payment volumes increasing, SMBs are under pressure to control costs and ensure their provider delivers value. According to recent studies, payment processing revenue share of SMBs is rising. J.D. Power+1

SMB insight: Negotiate your merchant services contract carefully—look at interchange rates, monthly fees, terminal/SDK costs, and demand clarity on what you’re getting.

Technology angle: Modern payment platforms offer subscription pricing, interchange-plus models, dashboards, analytics and value-added services (fraud monitoring, recurring billing, loyalty programmes) to differentiate.

6. Greater Regulatory & Compliance Focus, and Open Banking

As payments evolve, so do regulation, data-protection, and open banking / open finance models. SMBs need to ensure providers are compliant and secure. Deloitte

SMB insight: If you operate across borders or accept new payment types, ensure your merchant services provider supports local regulatory compliance (KYC, AML, data-security) and is prepared for future changes.

Technology angle: APIs that connect to open banking, secure onboarding flows, digital identity verification, and privacy-first architectures are becoming essential.

7. Surcharging & Cash Discount Programs on the Rise

As processing costs continue to climb, more merchants are turning to surcharging (passing card fees to customers) and cash discount programs (offering a lower price for cash payments). In 2025, these models have become mainstream among SMBs that want to keep profits predictable without raising menu or product prices.

SMB insight: With inflation and card-network fee hikes, programs like “zero-fee processing” or “no-cost credit card acceptance” are helping small businesses stay competitive.

Technology angle: Modern POS systems—such as Clover POS, Dejavoo QD2, and PAX A920 Pro—now include built-in apps that automate compliant surcharging and receipt disclosures, ensuring merchants stay aligned with state and card-brand rules.

What SMBs Should Do Now

-

Evaluate your existing payments stack: Are you offering the methods customers expect? Is your settlement speed acceptable?

-

Ask your provider the tough questions: “What’s your fraud-detection capability?” “Do you support digital wallets / BNPL?” “What are true effective rates (including hidden fees)?”

-

Budget for technology upgrades: If you’re stuck with legacy terminals, disconnected checkout flows or manual processes, you’ll incur more cost or lose customers.

-

Choose a flexible, future-ready partner: One that supports omnichannel, scales with you, offers transparent pricing and integrates with your business systems.

-

Stay informed: The payment processing landscape is changing quickly—what’s cutting-edge now may be baseline next year.

Wrap-Up

For SMBs in 2025, the payment processing trends are clear: speed, flexibility, digital wallets/alternatives, AI-driven security, and integrated systems will define success. By aligning your payment infrastructure with these trends, you’ll not only reduce friction and cost, but also deliver a better customer experience—and stay ahead of competitors who are still using yesterday’s tools and mindse