In today’s fast-paced marketplace, small retail business owners are constantly seeking ways to manage costs while maximizing profits. One of the prevalent financial challenges they face is the cost associated with credit card processing fees. Merchant surcharging has emerged as a strategic approach for businesses to address this issue. This comprehensive guide will explore merchant surcharging in the context of small retail businesses in the USA, providing valuable insights into its workings, legal landscape, benefits, drawbacks, and implementation strategies.

Introduction to Merchant Surcharging

Merchant surcharging refers to the practice of passing on the cost of credit card processing fees to customers who choose to pay using credit cards. This cost-shifting strategy can be a game-changer for small businesses, helping them reclaim a portion of the expenses incurred from accepting credit card payments. With the proliferation of digital payments, understanding how surcharging works can offer a competitive edge to small retailers.

Why Merchant Surcharging Matters

In an era where convenience often trumps cost, many consumers prefer to use credit cards for their transactions. While this offers businesses an opportunity to increase sales, the associated processing fees can eat into profits. By implementing surcharging, businesses can potentially offset these fees, thus protecting their margins without deterring sales.

How Credit Card Processing Works for Small Businesses

To grasp the benefits and challenges of surcharging, it’s essential to understand how credit card processing works. When a customer pays with a credit card, several parties are involved in the transaction process:

- The Merchant: The business accepting the payment.

- The Customer: The cardholder making the payment.

- The Acquirer: The bank or financial institution that processes card payments on behalf of the merchant.

- The Issuer: The bank that issued the customer’s credit card.

- The Card Network: Networks like Visa, MasterCard, or American Express that facilitate the transaction.

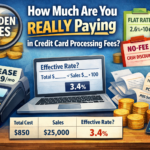

Each transaction incurs various fees, including interchange fees, assessment fees, and processor fees, which can range from 1.5% to 3.5% of the transaction value. For small businesses operating on tight margins, these fees can accumulate quickly, making surcharging an attractive option.

Legal and Regulatory Landscape of Merchant Surcharging in the USA

Understanding the legal framework surrounding surcharging is crucial to implementing it effectively and lawfully. Here’s an overview of the regulatory environment:

Federal Regulations

At the federal level, surcharging is permitted, but businesses must adhere to specific guidelines. The Dodd-Frank Wall Street Reform and Consumer Protection Act played a pivotal role in allowing merchants to implement surcharges. However, it mandates that merchants must clearly disclose the surcharge to customers before completing the transaction, ensuring transparency.

State Laws

While federal law permits surcharging, individual states have the authority to regulate or prohibit the practice. Currently, states like California, Colorado, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma, and Texas have laws restricting or outright banning surcharges on credit card transactions. Small business owners must familiarize themselves with their state’s legislation to ensure compliance.

Card Network Rules

Each card network has its own rules regarding surcharging. For instance, Visa and MasterCard require merchants to notify them of their intent to surcharge at least 30 days before implementation. Additionally, the surcharge amount cannot exceed the merchant’s actual cost of processing or 4%, whichever is lower.

Benefits and Drawbacks of Surcharging for Small Business Owners

Benefits

- Cost Recovery: The primary advantage of surcharging is the ability to recover credit card processing fees, thereby improving profit margins.

- Pricing Transparency: By clearly showing customers the cost of credit card payments, surcharging promotes pricing transparency and encourages customers to consider alternative payment methods.

- Competitive Advantage: Staying informed and adapting to industry trends like surcharging can position a business as forward-thinking and financially savvy.

Drawbacks

- Potential Customer Pushback: Some customers may view surcharges unfavorably, potentially impacting customer satisfaction and loyalty.

- Complex Implementation: Navigating the legal, technical, and administrative aspects of surcharging can be challenging for small businesses without dedicated resources.

- Limitations by State: Varying state laws can complicate the decision to adopt surcharging, necessitating a thorough understanding of regional regulations.

Step-by-Step Guide to Implementing Surcharging

Successfully implementing surcharging requires careful planning and execution. Follow these steps to ensure a seamless integration into your business model:

Step 1: Research Legal Requirements

Begin by researching federal and state regulations governing surcharging. Ensure compliance with card network rules and consult legal counsel if necessary to avoid potential liabilities.

Step 2: Notify Card Networks

If surcharging is permissible in your location, notify the relevant card networks (e.g., Visa, MasterCard) of your intent to implement surcharges, as required by their policies.

Step 3: Update Point-of-Sale (POS) Systems

Work with your payment processor to update your POS systems to accommodate surcharges. This may involve software upgrades and staff training to ensure accuracy and compliance.

Step 4: Communicate with Customers

Transparency is key. Clearly communicate the surcharge to customers through signage at the point of sale, on receipts, and in online transactions. Educate your staff to explain the rationale and address customer inquiries.

Step 5: Monitor and Evaluate

After implementation, monitor customer reactions, sales metrics, and overall satisfaction. Gather feedback to refine your approach and ensure the surcharge doesn’t negatively impact your business.

Case Studies of Successful Surcharging Strategies

Case Study 1: Local Coffee Shop

A small coffee shop in a state permitting surcharges decided to implement a 2% surcharge on credit card transactions. By clearly communicating this policy to customers, the shop was able to recover over $12,000 annually in processing fees without notable customer complaints. The owner noted an increase in cash payments, further reducing fees.

Case Study 2: Boutique Retail Store

In a boutique retail store in a state with stricter regulations, the owner leveraged technology to inform customers of the surcharge policy through digital displays at the checkout. While some initial resistance was met, the store’s commitment to transparency and exceptional customer service led to acceptance and increased profitability.

Future Trends and Considerations

The landscape of credit card processing and merchant surcharging is continually evolving. Small business owners should stay informed about emerging trends and adapt their strategies accordingly.

Contactless and Alternative Payments

With the rise of contactless payments and digital wallets, businesses may need to consider offering diverse payment options to cater to changing consumer preferences.

Regulatory Changes

Stay informed about potential changes in federal and state regulations regarding surcharging. Engaging with industry associations and legal experts can help businesses remain compliant.

Customer Education

Continual education and communication with customers about the benefits of surcharging can help mitigate any negative perceptions and build trust.

Conclusion

Merchant surcharging offers a viable solution for small retail business owners to manage credit card processing costs and protect their profit margins. By understanding the legal landscape, benefits, and implementation steps, businesses can make informed decisions about adopting this strategy. While challenges exist, a well-executed surcharging policy can yield significant rewards.

For small business owners seeking to explore surcharging further, or those in need of assistance with implementation, our team offers expert consulting services tailored to your unique needs. Contact us today to learn how we can help you optimize your payment processing strategy for long-term success.