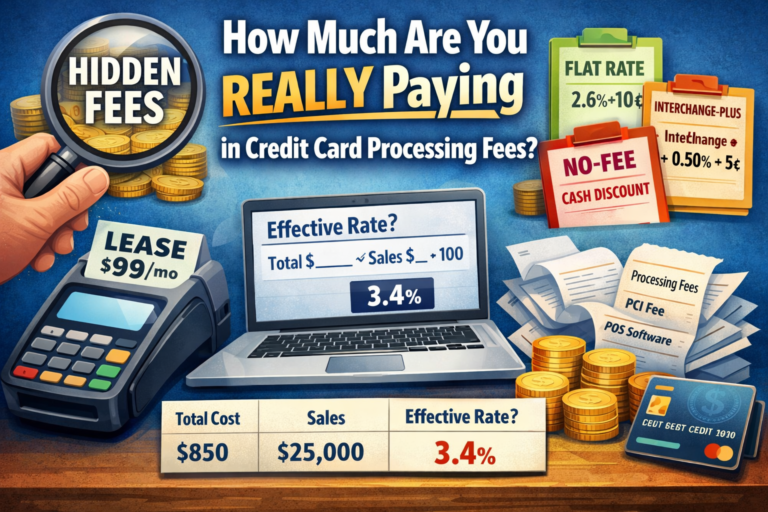

Navigating the world of payment processing can be daunting, especially with various fees and charges cutting into your profits. That’s where merchant cash discount programs come in. These innovative programs can help businesses save money by passing credit card processing fees onto customers. But what exactly is a merchant cash discount program, and how does it differ from credit card surcharging? Let’s explore this and more in our comprehensive guide.

Introduction to Merchant Cash Discount Programs

Running a business comes with its fair share of challenges, and one of the most significant is managing costs, particularly those associated with credit card processing. To alleviate these expenses, many businesses are turning to merchant cash discount programs or no-fee programs. These programs allow you to pass the cost of credit card processing fees onto your customers, effectively reducing your expenses. In this blog, we’ll break down what these programs entail, how they differ from credit card surcharging, and why they might be the right choice for your business.

What is a Merchant Cash Discount Program?

A merchant cash discount program is a payment processing strategy where businesses offer a discount to customers who pay with cash. Conversely, customers who choose to pay with a credit card will not receive the discount and will effectively cover the processing fees. This approach can be a win-win for both merchants and customers, as it encourages cash payments while still allowing the option of credit card payments.

How Does Merchant Cash discount Work?

In a cash discount program, the listed prices of goods and services include the credit card processing fee. When a customer pays with cash, they receive a discount equivalent to the fee, resulting in a lower price. For example, if an item is priced at $10 with credit card fees included, a cash-paying customer might only pay $9.50.

Legal Considerations

It’s crucial to note that while cash discount programs are legal in all states, there are specific regulations and requirements you must follow. Ensure your pricing is transparent, and customers are aware of the discount for cash payments to avoid any legal issues.

Benefits for Merchants

- Cost Savings: By passing on credit card fees to customers, businesses can save significantly on processing costs.

- Increased Cash Flow: Encouraging cash payments can lead to faster access to funds without the delays associated with credit card processing.

- Simple Implementation: Many payment processors provide easy-to-use systems for implementing cash discount programs.

What is Credit Card Surcharging?

Credit card surcharging, on the other hand, involves adding a fee to the customer’s total when they choose to pay with a credit card. This fee covers the cost of credit card processing, ensuring that the business does not absorb these costs.

How Does It Work?

When a customer opts to pay with a credit card, a surcharge is added to their total bill. For example, if an item costs $10 and the surcharge is 3%, the customer would pay $10.30 if they use a credit card.

Legal Considerations

Surcharging is subject to more stringent regulations than cash discount programs. While it is legal in most states, certain states prohibit surcharges or have specific guidelines that must be followed. It’s essential to stay informed about the laws in your state to ensure compliance.

Benefits for Merchants

- Cost Recovery: Surcharging allows businesses to recover the costs associated with credit card processing directly from customers.

- Customer Choice: Customers can choose whether to pay the surcharge or use an alternative payment method.

- Revenue Protection: By passing on processing fees, businesses can protect their profit margins.

Key Differences Between Cash Discount Programs and Surcharging

While both programs aim to reduce the financial burden of credit card processing fees, they operate differently and have distinct implications for businesses and customers.

Pricing Transparency

In a cash discount program, the listed prices include credit card fees, and customers receive a discount for paying with cash. This approach promotes transparency and ensures that all customers see the same prices, regardless of the payment method.

Customer Perception

Surcharging can sometimes be perceived negatively by customers, as it involves adding an extra fee to their total bill. On the other hand, cash discount programs frame the fee as a discount for cash payments, which can be more positively received.

Legal and Regulatory Requirements

Surcharging is subject to stricter regulations and varies by state, while cash discount programs are generally legal nationwide with fewer restrictions. Businesses must ensure they comply with the specific rules governing each program type.

Implementation and Technology

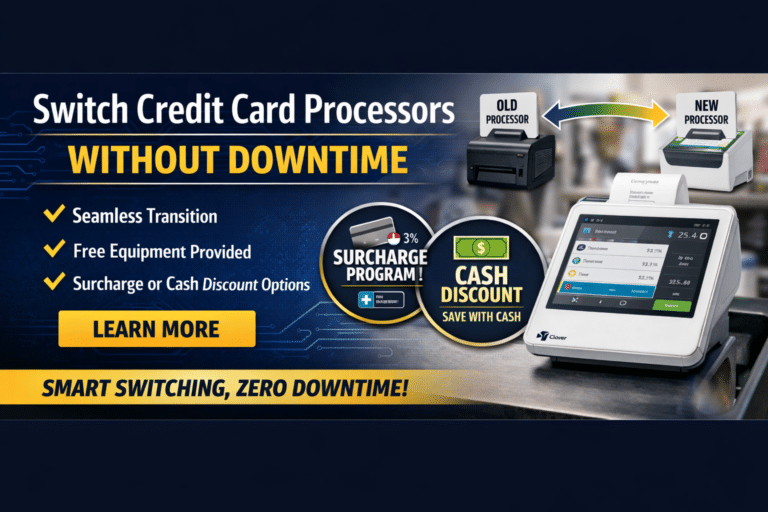

Both programs require businesses to use compliant point-of-sale (POS) systems that can handle the appropriate pricing and fee calculations. Many payment processors offer solutions tailored to each program, making implementation straightforward.

How to Implement a Merchant Cash Discount Program

If you’re considering a merchant cash discount program for your business, follow these steps to ensure a smooth and successful implementation.

Choose the Right Payment Processor

Select a payment processor that offers a robust cash discount program with easy integration into your existing systems. Look for features like automatic fee calculations and transparent reporting.

Update Your Pricing and Signage

Ensure your pricing includes the credit card processing fees and clearly communicate the cash discount to customers. Update your signage and online pricing to reflect this information transparently.

Train Your Staff

Educate your staff about the cash discount program and how to explain it to customers. Ensure they understand the benefits for both the business and the customers.

Monitor Compliance and Customer Feedback

Regularly review your program to ensure compliance with regulations and gather customer feedback to address any concerns or confusion. Adjust your approach as needed to maintain a positive customer experience.

How to Implement Credit Card Surcharging

If a credit card surcharging program better suits your business needs, follow these steps to get started.

Understand Your State’s Regulations

Research the surcharging laws in your state to ensure compliance. Some states have specific requirements for surcharge amounts, disclosures, and prohibited practices.

Choose a Compliant Payment Processor

Work with a payment processor that supports surcharging and provides compliant POS systems. Ensure the processor can handle the specific requirements of your state.

Update Your Pricing and Documentation

Clearly communicate the surcharge policy to customers through signage, receipts, and online information. Ensure your pricing documents reflect the surcharge details transparently.

Train Your Staff

Educate your staff about the surcharging program and how to explain it to customers. Provide them with the necessary tools to handle any questions or concerns.

Monitor Compliance and Customer Feedback

Regularly review your surcharging program to ensure it complies with state regulations and gather customer feedback to address any issues. Make adjustments as needed to maintain a positive customer experience.

Case Studies of Successful Implementations

To illustrate the benefits of merchant cash discount programs and surcharging, let’s explore a few real-world examples of businesses that have successfully implemented these strategies.

Case Study 1: Small Retail Store

A small retail store implemented a cash discount program to offset rising credit card processing fees. By offering a 4% discount for cash payments, the store increased its cash transactions by 30% and saved thousands of dollars in processing fees annually.

Case Study 2: Restaurant Chain

A mid-sized restaurant chain decided to implement a surcharging program to recover credit card processing costs. By adding a 2% surcharge to credit card payments, the chain maintained its profitability while still offering customers the convenience of card payments.

Case Study 3: E-commerce Business

An e-commerce business adopted a hybrid approach, offering cash discounts for bank transfers and surcharging credit card payments. This strategy allowed the business to reduce processing costs while providing customers with multiple payment options.

Conclusion

Merchant cash discount programs and credit card surcharging offer valuable solutions for businesses looking to manage credit card processing fees effectively. By understanding the key differences between these programs and following the necessary steps for implementation, your business can benefit from cost savings, increased cash flow, and improved customer experiences.

Ready to take the next step? Explore our range of payment processing solutions and find the perfect fit for your business. Join the growing number of businesses that are leveraging these innovative strategies to thrive in today’s competitive market.