When starting or scaling a business, one of the vital decisions you’ll face is how to process payments. For many entrepreneurs, the names PayPal, Square, and Stripe often come to mind because of their simplicity and convenience. But attractive as these payment aggregators might seem at first glance, they bring a set of challenges that can hinder your business’s growth in the long run.

If you’re a small business owner, startup founder, or e-commerce entrepreneur, now is the time to consider a better alternative tailored to your needs—traditional merchant accounts. At Merchant Marvels, we’ve seen firsthand how a properly set up merchant account can not only save business owners money but also provide the stability, security, and customization they need to thrive.

Wondering why you should skip PayPal, Square, and Stripe? Here’s everything you need to consider.

The Problems with Payment Aggregators

1. Limited Control Over Funds

Imagine this—a high-volume sales week, lots of revenue flowing in, and suddenly, access to your money is delayed or frozen. Does that sound like a fictional nightmare? Unfortunately, it’s a reality for many businesses relying on payment aggregators.

Platforms like PayPal or Stripe operate as intermediaries, and as such, they can freeze your account or put holds on your funds at their discretion. This often happens when transactions trigger fraud detection systems, even if no fraud has occurred. For small businesses running on tight margins, limited cash flow can be disastrous, delaying essential expenses like inventory, payroll, and marketing.

On the other hand, with a traditional merchant account, you gain immediate and predictable access to your funds, ensuring stability for ongoing business operations.

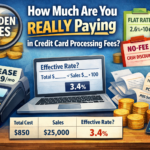

2. Higher Transaction Fees

Payment aggregators often advertise their services as “flat-rate” or “hassle-free.” But over time, those seemingly small percentages add up. For example, PayPal charges 2.9% + $0.30 per transaction—a fee that sounds reasonable until you compare it with the potential savings of a lower-rate merchant account.

For businesses with high transaction volumes or large-ticket items, these aggregator fees can cut deeply into your profits. With merchant accounts, you can often negotiate lower rates, especially if you process substantial monthly sales volumes. Those savings could be reinvested into growing your business instead of disappearing into unnecessary fees.

3. Less Customization for Your Brand

Your checkout process is an extension of your brand experience. Payment aggregators force you into cookie-cutter systems that limit your ability to design a seamless shopping flow. Without flexibility, you may struggle to deliver the quality, branding, and user experience that keeps your customers coming back.

A generic PayPal button at checkout, for example, lacks the professional and credible image expected by customers. A traditional merchant account, however, allows you to customize the checkout process to match your brand. From incorporating your logo to tailoring the design, you’ll have full control over how your business is represented to customers.

4. Security Concerns

Aggregators like PayPal and Square, being widely used platforms, are a prime target for cybercriminals. While these companies invest heavily in security, breaches can still happen, affecting all businesses that use their services. Additionally, when something goes wrong, the liability may not fall solely on the aggregator—you may be held partially responsible for fraud affecting your account.

With a traditional merchant account, you benefit from enhanced security features tailored specifically to your business. Not only are these accounts equipped with advanced fraud protection, but they also help reduce your liability in the event of a breach. Many merchant account providers offer PCI compliance tools to ensure your transactions and customer data stay protected.

5. Risk of Account Suspension

Payment aggregators have strict terms of service that many small business owners unknowingly violate. Something as trivial as a transaction flagged as “unusual” could lead to an account freeze or suspension—often without warning or an easy path to resolution. One week without payment processing capabilities can cripple your business.

By contrast, traditional merchant accounts are established specifically for your business and come with dedicated support to address any concerns, reducing the risk of unexpected disruptions.

6. International Business Limitations

If your business attracts global customers, payment aggregators may throw a wrench in your plans. Not all countries are supported, and international transactions often come with additional fees, layers of complexity, or even outright restrictions.

A traditional merchant account removes these barriers, allowing you to process payments seamlessly regardless of your customers’ location. This opens up international markets and ensures that payments aren’t the bottleneck for business growth.

7. Limited Customer Support

When issues arise with payment aggregators, getting help can be a frustrating experience. Most support tends to be generalized, automated, or difficult to access in a timely manner. And when you’re dealing with a frozen account or failed transaction, waiting hours—or even days—for a resolution can cost your business serious money.

On the other hand, traditional merchant accounts often come with dedicated customer support teams or account managers who understand your particular setup and can address issues quickly and effectively.

8. Long-Term Stability Concerns

Choosing a payment aggregator places your business at the mercy of its policies. These companies can change their fee structures, features, or terms of service at any time. If that happens, you’re left scrambling to find a new solution—potentially disrupting operations or confusing customers.

Traditional merchant accounts provide a more stable and transparent structure. They’re designed for long-term use, offering consistent services and predictable terms you can rely on as your business grows.

Why Choose a Traditional Merchant Account?

1. Immediate Access to Funds

No surprise holds. No unexpected freezes. With a merchant account, your money is your money, accessible without hurdles.

2. Lower Transaction Fees

Save more with competitive rates tailored to your business needs, enabling you to reinvest in growth and profitability.

3. Exclusive Customization

Your checkout reflects your brand—not a generic button. Enhance customer satisfaction and trust with a checkout system that’s uniquely yours.

4. Bulletproof Security

Reduce fraud risks with enhanced security measures and lower liability, giving you peace of mind.

5. Better Global Reach

Expand into international markets without limitations, opening doors to new revenue streams.

6. Reliable Support

When challenges arise, professional and dedicated support teams will have your back, ensuring smoother operations.

7. Long-Term Predictability

Enjoy stable terms and transparent policies, laying a secure foundation for business scalability.

A Merchant Account Partner You Can Trust

At Merchant Marvels, we understand that each business has unique needs. That’s why we work closely with business owners like you to provide tailored merchant account solutions that address all your payment processing challenges. Whether you run an online store, a local business, or a multi-channel enterprise, we make it simple to switch and upgrade from a payment aggregator.

Our goal isn’t just to save you money—it’s to empower your business with financial and operational stability. Say goodbye to surprises and frustrations, and say hello to a seamless, secure, and scalable way of managing payments.

The Bottom Line

Payment aggregators like PayPal, Square, and Stripe may seem appealing at first, with quick setups and plug-and-play features. But for serious business owners focused on building long-term success, the disadvantages—limited funds access, high fees, lack of customization, and security concerns—can outweigh the convenience.

A traditional merchant account, on the other hand, offers everything you need to grow your business efficiently and securely. From lower fees to personalized support and unrivaled stability, the choice is clear.

Your business deserves the best payment processing solution available. Don’t settle for less.

Join Merchant Marvels today and experience the benefits of a dedicated merchant account. Contact us to get started and take control of your business payments!